The government seized First Republic Bank and auctioned off most of its assets to JPMorgan Chase, making it the third major bank to fail in the United States in under two months.

A weekend takeover by the Federal Deposit Insurance Corporation (FDIC) preceded its supervision of First Republic’s sale via a “highly competitive bidding process.”

JPMorgan announced in a news release that it will acquire “substantial amounts of their assets and certain liabilities,” including customer deposits at First Republic.

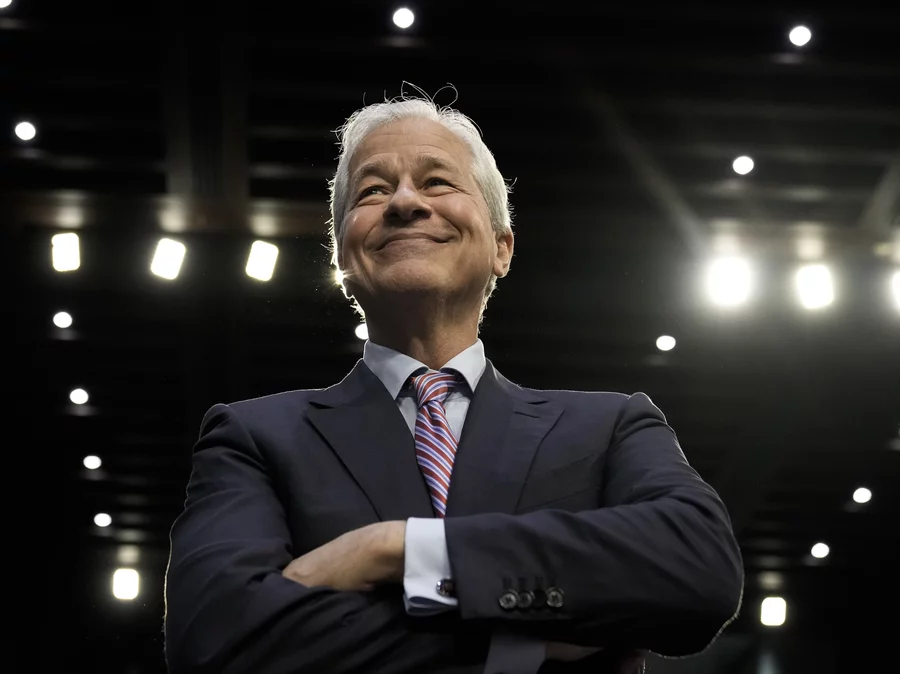

“Our government invited us and others to step up, and we did,” said JPMorgan Chase CEO Jamie Dimon in a statement. We believe this acquisition will have a small positive impact on our firm as a whole, will be accretive to our shareholders, will aid in the development of our wealth strategy, and will complement our current franchise.

On Monday, all 84 First Republic locations reopened as JPMorgan Chase Bank branches, giving customers full access to their funds.

As the final event of a rough week for First Republic, its takeover is the latest in a string of banking crises that have shaken the U.S. economy.

When First Republic reported last Monday that it had lost almost $100 billion worth of deposits during the first three months of the year, it began its death spiral in earnest. The bank has been struggling since the U.S. took over Silicon Valley Bank and Signature Bank in March.

Last week, its stock price dropped so drastically that trading on the New York Stock Exchange had to be halted dozens of times. Shares dropped 97% in value this year, closing at $3.51 on Friday.

On Monday, Vice President Biden expressed his approval of the seizure and sale of First Republic, stating that it would “make sure that the banking system is safe and sound,” while also stressing that taxpayers would not be responsible for the rescue.

Death spiral

Since JPMorgan Chase acquired Washington Mutual in 2008, First Republic has become the largest failed U.S. lender.

Both Silicon Valley Bank and Signature Bank experienced a run on the bank in March, with depositors desperately trying to withdraw their money, prompting federal authorities to step in and protect clients.

All deposits at the two banks were insured, including those that were beyond the $250,000 limit set by the FDIC, in an unprecedented move motivated by concerns for the stability of the broader financial system.

After the collapse of those two financial institutions, researchers began looking for other institutions that might be susceptible to a run on deposits and quickly settled on First Republic.

The bank, established in San Francisco in 1985, provided mortgages and business loans primarily to affluent customers.

In March, 11 of the largest banks in the country, led by JPMorgan, placed $30 billion into First Republic in an effort to boost confidence.

Investors on Wall Street were unconvinced, and customers kept pulling their money out.

Few choices remained for the First Republic.

The government was ultimately forced to intervene after First Republic’s efforts to sell the company were unsuccessful.

The FDIC solicited bids from a number of financial institutions, but the contract ultimately went to JPMorgan Chase, the largest bank in the United States.

JPMorgan Chase, according to Dimon, “minimized costs” to the FDIC’s Deposit Insurance Fund in its bid for First Republic.

The seizure and sale of First Republic is expected to cost the FDIC’s insurance fund over $13 billion.

The deal comprises the “assumption of approximately $92 billion of deposits” held by First Republic, as well as the purchase of “approximately $173 billion of loans and around $30 billion of securities”

The banking sector has calmed down.

However, the situation is more tranquil now than it was after the failures of Silicon Valley Bank and Signature.

Deposit withdrawals have generally steadied, according to earnings reports from smaller lenders this month.

Lenders were proactive, so “that fear, that mass exodus that people were concerned about just didn’t happen,” says Jared Shaw, a bank analyst at Wells Fargo Securities.

The banks performed an excellent job of communicating with their clients and providing details about their liquidity and balance sheets.

In addition, federal regulators made clear that First Republic’s difficulties were an outlier.

“Americans should feel confident in the safety of their deposits and the ability of the banking system to fulfill its essential function of providing credit to businesses and families,” a Treasury Department spokesperson said.

After the announcement of the deal, Dimon told reporters that he expected the same thing to happen.

“The system is very, very sound,” he said.

Current Attention: Banking Regulations

While regulators are being held accountable for the failures of Silicon Valley Bank and Signature Bank, the FDIC is taking action.

On Friday, the Federal Reserve acknowledged responsibility for Silicon Valley Bank’s demise, saying it should have exercised stricter oversight of the bank.

The Fed also suggested making banks and other financial institutions more closely monitored, particularly by bringing in more smaller lenders.

On Monday, the FDIC published a paper outlining potential adjustments to the United States’ deposit system.

According to the FDIC’s assessment, encouraging banks to take risks by providing unlimited deposit insurance would be prohibitively expensive.

However, it did find that raising the insurance threshold for specific business accounts could have benefits, especially when combined with other measures like curbs on cash withdrawals.

Congress would have to approve any changes to the deposit insurance system.