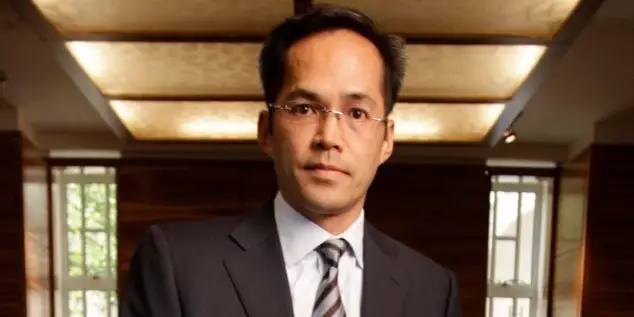

Stephen Jen is a prominent economist, cofounder and chief executive officer of Eurizon SLJ, and creator of the “dollar smile” theory. This dialogue has been gently edited for clarity and length.

Phil Rosen: You recently stated that the dollar’s position as the world’s reserve currency experienced a sharp decline in 2022. Can you elucidate what drove this trend and whether it will continue?

The US’ use of exceptional sanctions, including the freezing or confiscation of half of Russia’s $620 billion in foreign reserves and the outright confiscation of assets owned by Russian oligarchs, is our best estimate as to the primary cause of this.

We believe this trend will continue, but not to the point where a non-dollar currency commands a larger market share than the dollar.

A unipolar reserve currency world will evolve into a multipolar reserve currency world.

There is much talk about the yuan as a potential competitor to the dollar. What must occur for this to become a reality?

The integrity of China’s financial sector must be enhanced. It will take many years before the RMB can compete with the USD, I’m concerned.

Foreigners are still hesitant to invest in Chinese stocks and bonds, and the United States is working hard to make this as difficult as possible.

Chinese savers and households cannot be permitted to invest abroad if there is no foreign demand for Chinese assets; consequently, capital controls must remain in force.