Whitehaven Coal Limited (ASX: WHC) shares lost 2.168% to AU$ 7.220 on Monday, April 24, 2023, lagging the S&P/ASX 200 index, which fell 0.11% to 7,322.00. Despite today’s drop, WHC shares are up almost 11% in the previous month, compared to nearly 2.5% for the ASX 200 index.

The energy business reported its January-March production last week. The coal company said its run-of-mine (ROM) production declined 12% sequentially to 4.3 million tonnes, while its average realised coal price plummeted 24% sequentially to AU$400 a tonne, up 27% annually. The company reported 3.4 million tonnes of coal revenue, down 2% quarterly and 5% annually.

Following a good December quarter, the company’s Narrabri operation’s performance declined, resulting in a March quarter coal production reduction. Despite floods last quarter, Maules Creek mine production rose 9%.

WHC CEO and managing director Paul Flynn believes the company will benefit from high coal demand. The company began delivering coal to NSW power units at AU$125 per tonne in April.

WHC spent AU$100 million on on-market share buybacks.

Given this, let’s examine WHC’s price chart.

WHC shares are holding above the upward-sloping trendline support level on the weekly chart, suggesting further gain.

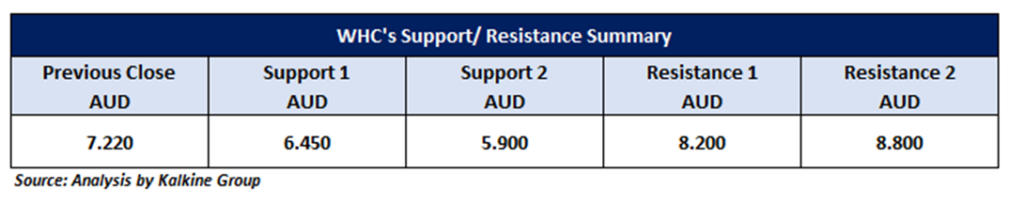

The stock may test its next resistance level at AU$ 8.20 in the next few days or weeks. WHC shares can rise to AU$ 8.80 if they break above AU$ 8.20 with significant volume.

Technical Indicators Analysis (Weekly Chart)

The weekly chart shows RSI (14-period) at the midway at ~45.41, recovering from lower levels. Volume analysis supports stock prices. The CMP is below the trend-following indicators 21-period and 50-period SMA, which may operate as resistance levels.

Technical indicators:

Support: A position where falling stock prices may stall due to demand or buying activity. If the stock breaks Support 1, Support 2 may become its key support level.

Resistance: A level where increasing stock prices may stall due to profit booking or selling interest. If the stock price exceeds Resistance 1, Resistance 2 may become the stock’s important resistance level.

Stop-loss: Protects against stock price declines.

21-period moving average is green. SMA shows price trends. If prices are above the 21-period, they are optimistic.

50-period moving average is blue. SMA shows price trends. If prices are above the 50-period, they are bullish.

Trendline is orange/yellow.

The Relative Strength Index (14-Period)’s purple line in the chart’s lower portion indicates price momentum and trend momentum. Overbought is 70 or above, while oversold is 30 or below.