According to Fintel, RBC Capital reiterated coverage of ADT (NYSE:ADT) with a Sector Perform recommendation on May 3, 2023.

Analyst Price Predictions Point to an Increase of 81.61%

The average price target for ADT during the next year is 10.37 as of April 24, 2023. Forecasts range from an 8.08 low to a 13.65 high. From its most recent reported closing price of 5.71, the average price goal reflects a rise of 81.61%.

Check out the companies on our leaderboard with the highest price target upside.

ADT’s estimated yearly revenue will increase by 7.13% to $6,924 million. The non-GAAP EPS for the upcoming year is 0.77.

What is the mood of the funds?

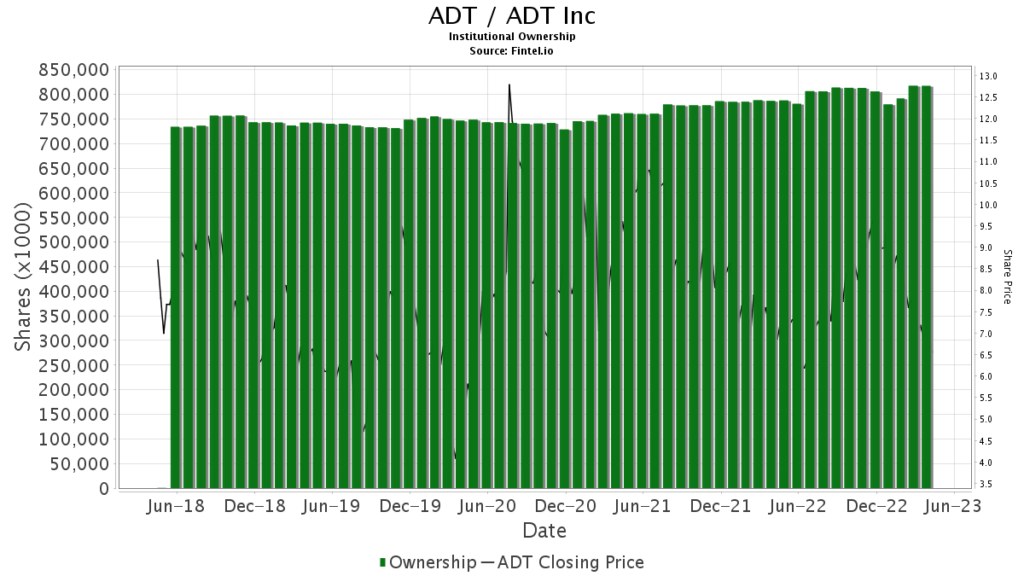

ADT reports positions from 525 funds or institutions. This represents a rise of 31 owners, or 6.28%, over the previous quarter. The average portfolio weight of all funds with an ADT focus is 0.22%, a 46.40% drop.

Institutional ownership of total shares climbed by 3.24% over the past three months to 817,198K shares. Put/Call Ratios for ADT / ADT Inc.ADT’s put/call ratio is 0.61, which suggests a positive view.

What are the actions of other shareholders?

Institutional Ownership of ADT / ADT Inc. Shares Apollo Management Holdings owns 498,300K shares, or 54.07% of the firm. The firm disclosed owning 608,928K shares in its last filing; this represents a reduction of 22.20%. Over the previous quarter, the company reduced its portfolio allocation to ADT by 8.98%.

State Farm Mutual Automobile Insurance owns 133,333,00 shares in the company, or 14.47% of it.

Ariel Investments is the owner of 1.83% of the corporation, or 16,825K shares. The firm reported owning 18,190K shares in its previous filing, a decline of 8.11%. Over the previous quarter, the company increased its portfolio allocation to ADT by 5.67%.

Alliancebernstein is the owner of 16,647,K shares, or 1.81% of the company. The company reported owning 19,628K shares in its previous filing, a decline of 17.91%. Over the previous quarter, the company reduced its portfolio allocation to ADT by 4.53%.

Mgg Investment Group is the owner of 11,634K shares, or 1.26% of the firm. The company reported owning 22,921K shares in its previous filing, a decline of 97.01%. Over the previous quarter, the company reduced its portfolio allocation to ADT by 99.90%.

Background Information on ADT

With more than 200 sites, 9 monitoring centers, and the largest security professional network in the country, ADT serves both residential and commercial customers as a leading provider of security, automation, and smart home solutions.

The firm provides lifestyle-driven solutions via professionally installed, do-it-yourself, mobile, and digital options for residential, small business, and larger commercial customers, offering a variety of approaches to assist protect customers.